Charter School Financing: Myths vs. Facts

Charter School Financing: Myths vs. Facts

From funding your growth, managing deferrals, to investment in facilities, get ahead of the game knowing these five charter school financing myths & facts!

MYTH: Charter schools should use their reserves to finance growth instead of looking for outside financing options.

FACT: Using outside financing to facilitate growth can make a charter more financially secure in the long run and pay for continued growth without depleting cash reserves.

MYTH: Growth capital should only be used in the case of state funding delays or deferrals or as a last resort.

MYTH: Growth capital should only be used in the case of state funding delays or deferrals or as a last resort.

FACT: Growth capital is incredibly flexible and can be used for operational growth, program enhancements, technology upgrades, school expansion, etc.

MYTH: Running a charter school is not like running a business.

MYTH: Running a charter school is not like running a business.

FACT: A charter school is a business and making smart, informed business decisions will benefit your school’s viability, financial health and overall growth.

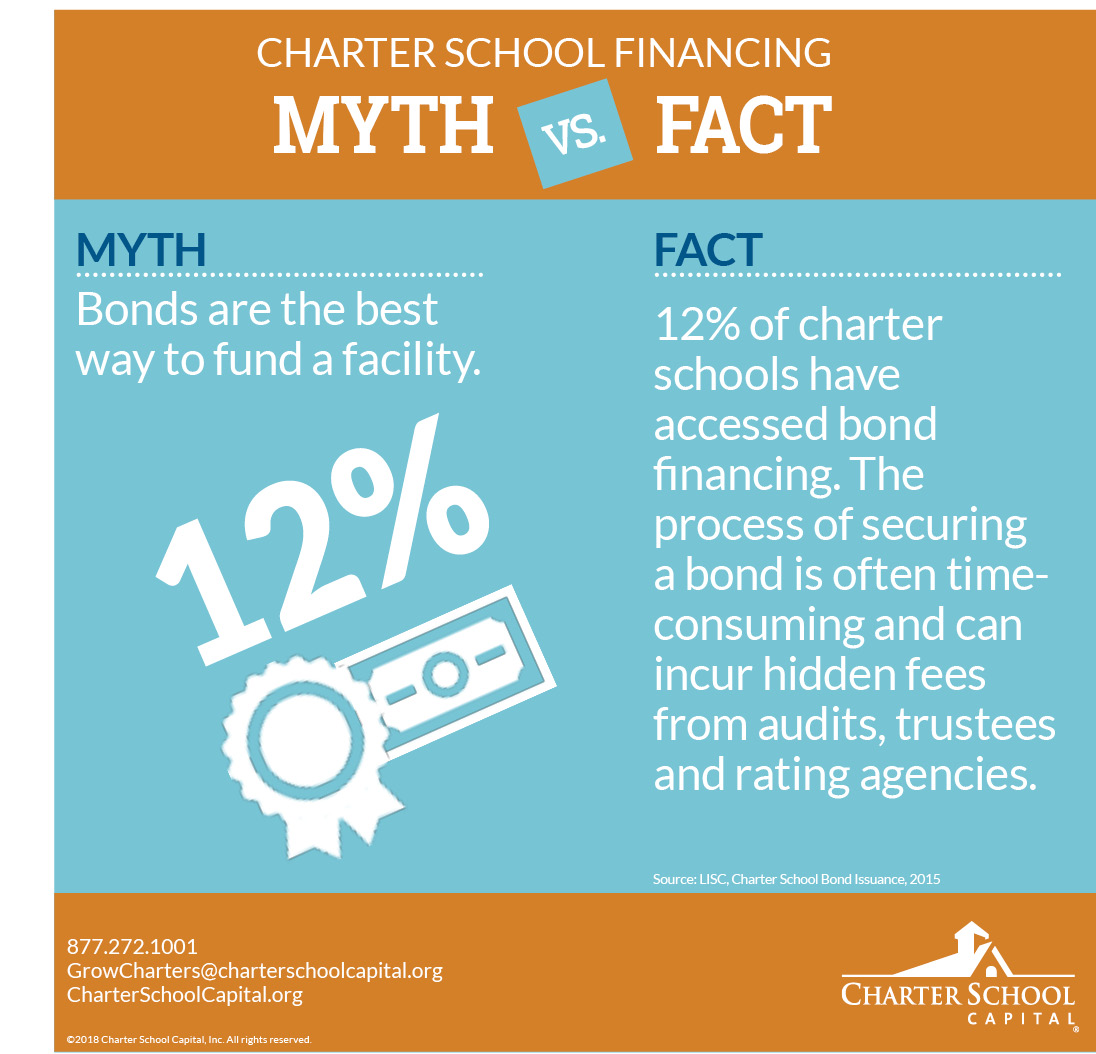

MYTH: Bonds are the best way to fund a facility.

MYTH: Bonds are the best way to fund a facility.

FACT: Only 12% of charter schools have accessed bond financing. The process of securing a bond is often time-consuming and can incur hidden fees from audits, trustees and rating agencies.

Source: LISC, Charter School Bond Issuance, 2015

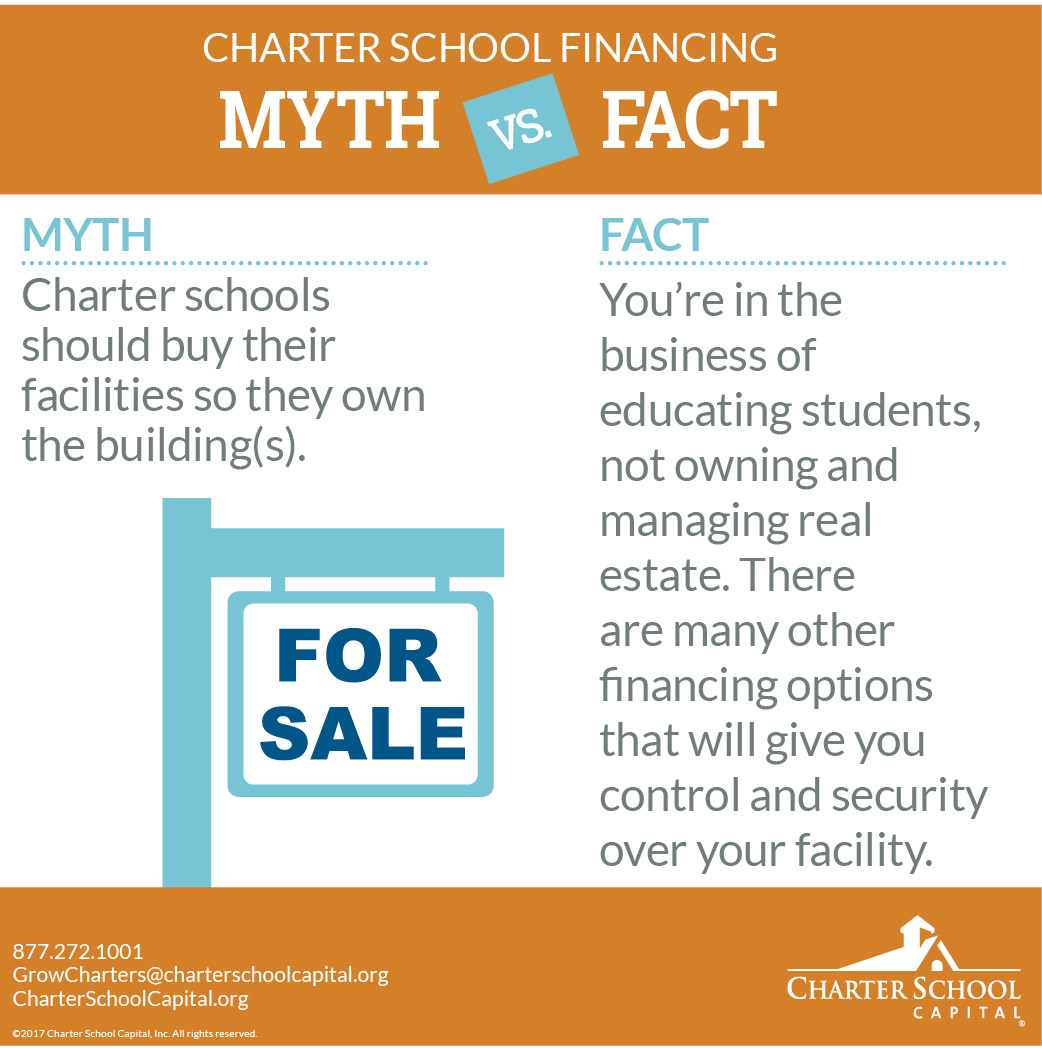

MYTH: Charter schools should own their facilities.

MYTH: Charter schools should own their facilities.

FACT: You’re in the business of educating students, not owning and managing real estate. There are many other financing options that will give you control and security over your facility.

If you’d like to download the PDF version of this infographic, click here.

Charter School Budgeting Best Practices: Don’t Just Survive–Thrive!

Since the opening of Charter School Capital 10 years ago, we’ve reviewed thousands of charter school budgets. Year after year, we see common mistakes many charter schools make when budgeting for their academic year. Hear from charter school finance experts as they give you a breakdown of budgeting best practices to help you have a financially successful academic year. Don’t just survive — thrive!