The Bridge to Bond: How to Finance Pre-Bond Facility Expenses

Charter School Capital is constantly innovating solutions to support charters at all stages of growth. As such, we have created a bridge to bond solution to cover up to 100% of pre-bond financing costs, without requiring schools to tap into cash reserves.

In addition to pre-bond financing, our bridge financing solution can be used for debt consolidation, land acquisition, tenant improvements, or mortgage down payments. We offer competitive rates and customized and flexible financing terms to get you the financing you need at a cost you can afford.

WHAT IS BRIDGE TO BOND FINANCING?

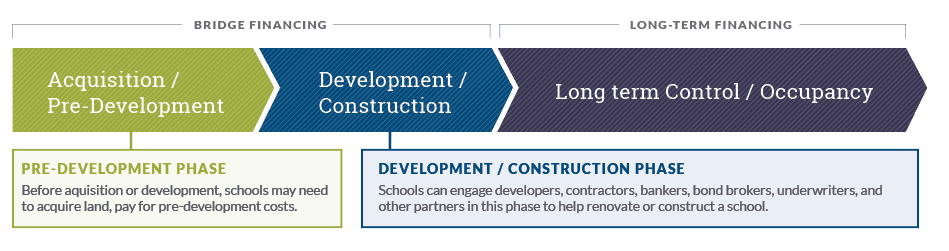

This type of bridge financing is designed to help schools with short to mid-term pre-development and development investments needed in advance of long term / permanent facilities financing.

WHAT IS BRIDGE FINANCING USED FOR?

Schools can use funds for a variety of purposes:

- Land acquisition

- Permitting / Entitlements

- Design fees

- Third-party reports

- Pre-construction

- Pre-open marketing expenses

- Zoning

- Survey work

- Working capital

BRIDGE TO BOND BENEFITS: FACILITIES BUDGET VS. SCHOOL REVENUES

Bridge financing allows you to control your development/ construction timeline in order to avoid costly delays:

- Inconsistent construction timelines

- Paying additional and unnecessary rent on two locations (old site and new site)

- Attrition of students and staff due to mistrust, damage to school’s reputation, or lack of (or uncertainty around) facility access

WHY CHOOSE CHARTER SCHOOL CAPITAL?

We are 100% dedicated to your charter school’s success.

Working seamlessly with your other lenders, we’ll get you the financing you need at a cost you can afford. We are proud to offer:

- 100% financing

- Competitive Rates

- Customized and flexible financing terms and conditions

- Our deep experience working with other lenders

We also proud to offer additional services including:

- Growth capital

- Enrollment marketing

- Facilities financing

- Advisory services to help you stay on track and achieve your goals

*Loans made or arranged pursuant to a California Finance Lenders Law license ##603F028

Since the company’s inception in 2007, Charter School Capital has been committed to the success of charter schools. We help schools access, leverage, and sustain the resources charter schools need to thrive, allowing them to focus on what matters most – educating students. Our depth of experience working with charter school leaders and our knowledge of how to address charter school financial and operational needs have allowed us to provide over $2 billion in support of 600 charter schools that have educated over 1,027,000 students across the country. For more information on how we can support your charter school, contact us. We’d love to work with you!

Since the company’s inception in 2007, Charter School Capital has been committed to the success of charter schools. We help schools access, leverage, and sustain the resources charter schools need to thrive, allowing them to focus on what matters most – educating students. Our depth of experience working with charter school leaders and our knowledge of how to address charter school financial and operational needs have allowed us to provide over $2 billion in support of 600 charter schools that have educated over 1,027,000 students across the country. For more information on how we can support your charter school, contact us. We’d love to work with you!